The problem of side-effects and third parties

Susse Georg & Inge Røpke

Production and consumption involve both the use of resources and the emission of waste materials, which may cause two kinds of problems: First, resources can be overexploited and secondly, the waste materials from the process can have adverse effects. Neither of these can be said to be the aim of the process, so they must be defined as unintentional side-effects, which often affect people who derive no benefit from the production and consumption process that has caused the problems. In this case, the side-effects are said to affect third parties, which refer to people and not damage to animals or plants unless the damage is important to humans (the perspective is, thus, anthropocentric, see the theme on view on nature and ethics).

Pollution problems are often side-effects that affect third parties. The classic example is of a company that emits waste into lakes or streams, which damages fish stocks and, thus, fishermen’s opportunities to catch fish. The same applies, of course, to the discharge of wastewater in towns and the leaching of nutrients from agricultural fertilisers, just as pollution affects interests other than fishing, for example, people’s opportunities for bathing. As detailed in Engberg’s book, Danish environmental history is rich in conflicts concerning the pollution of watercourses, and this continues today.

Right up until today, such conflicts have primarily been regulated through legislation involving bans and orders, often after a lot of discussion back and forth. Legislation prohibits various activities, for example, the use certain toxic substances in production, and the law demands that companies perform certain tasks in a prescribed manner. There is also extensive regulation of the products, so that users do not receive shocks from electrical items or become sick from eating food products, and so houses do not collapse. This removes the temptation for producers to make things as cheaply as possible regardless of any potential adverse side-effects for third parties.

Since the 1980s, it has become increasingly common to use other tools to regulate the conflicts, especially economic instruments. Economists, in particular, have argued that sometimes it is better to charge a tax, for example, on emissions of harmful substances instead of setting rules about how much pollution is allowed to be emitted. This is inappropriate, of course, if it concerns a substance that must be completely avoided, but if quantities need to be reduced, a tax can be useful. Firstly, it may be cheaper for society as a whole because the tax stimulates companies to reduce their emissions if it is relatively easy for them to do so, while emissions can continue in those companies for whom it is difficult to implement reductions – for them it is cheaper to pay the tax. Secondly, the tax provides an incentive for technical development, which in the longer term can reduce emissions in a more efficient way. Finally, the tax can raise funds for the treasury, which can, for example, use the money to solve some of the problems caused by the side effects.

In mainstream economics, side-effects are called externalities or external effects because they are external to the factors that are included in the decision-maker’s considerations. For example, a company is interested in the revenue and costs it has to include in its accounts, not the effects that affect others. Concerning the environment, the external effects are often negative, although they may also be positive. The classic example is bee-keeping, where it is not only the owner of the hives that benefits from the pollination of flowers. In mainstream economics, use of the term externality is often associated with the idea that, in principle, it is possible to calculate the economic value of the externality and that the introduction of a tax of the right size will ensure an ‘optimal’ result. In ecological economics, such an idea does not make sense because market prices are not considered to be a valid expression of what something is worth (see the section on value and prices in the theme on political decisions). However, ecological economists agree that in some contexts using charges as a means of control is useful, although their level must be set based on considerations other than the idea of optimality.

Economic instruments also include quotas that can be traded (such as the EU’s system of CO2 quotas and the Danish fishing quota system), and subsidy schemes to encourage, for example, the development of cleaner technologies. They may also take the form of payments to farmers or forest owners to run their businesses in an environmentally-friendly manner. This form of support is called payment for ecosystem services (PES). In addition to the economic instruments, there are a number of other tools such as the eco-labelling of products, environmental certification for companies, voluntary agreements with industry and many others (a little more can be found in the section on institutions in the theme on theoretical glasses).

Types of good and the overexploitation of resources

Up to now we have focused especially on pollution problems, but the exploitation of resources can be seen in the same perspective because it may also give rise to side-effects that impact third parties. For example, when rainforest is cut down, it affects many more than those who benefit from the felled trees or the cleared land. In the short term, those who used to use the forest for their livelihoods through harvesting fruit, rubber and engaging in other activities will be affected, while in the longer term, the climate will deteriorate, thereby affecting everyone. However, side-effects connected with the use of natural resources are often discussed in a supplementary perspective, which highlights some particular difficulties regarding regulation.

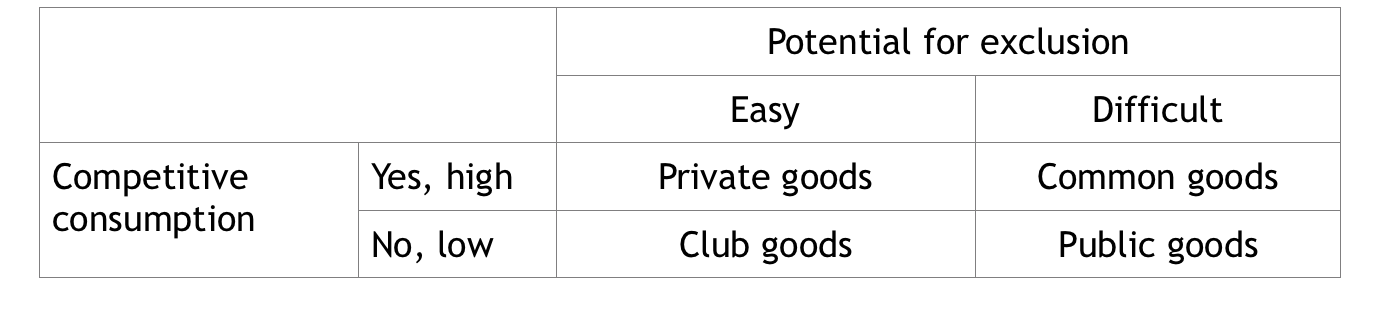

The perspective is based on a classification of goods into two dimensions. One dimension is concerned with whether an individual’s consumption of a good reduces what is available to others. If so, it is called competitive or rival consumption. A classic example is a piece of bread – if you eat a piece of bread, nobody else can eat it (unless the bread is shared). A classic example of non-rival consumption is the consumption of television signals, such as when we watch television – a household’s television consumption does not limit the ability of other households to watch television.

The second dimension concerns whether it is easy or difficult to exclude others from using the good. For example, if a person does not want to pay for a good, is it practically possible to exclude the person from using it? Goods that are sold in stores are protected by surveillance cameras and by law that punishes anyone who steals them. However, in other cases, it is hard to exclude people from using a good because it can not be fenced or protected in some other way. For example, it is difficult to monitor a forest to make sure that people do not help themselves to logs, even though it is not allowed. It is particularly difficult to prevent people from using a good that is not divisible, such as clean air, or the signals from a lighthouse.

Based on these two dimensions, goods can be classified into four different types, as presented below:

- If it is easy to exclude others from consuming the good, while at the same time an individual’s consumption reduces the consumption of others, it is called a private good. Typical examples are bottled water, food, clothing and many other types of good. If you drink the water or eat the food or wear the clothes, nobody else can do the same with these products.

- In cases where consumption of a good limits other people’s consumption of it only to a limited extent or not at all, it is called a club good (also called ticket goods). A classic example of this is when television signals are put together in ‘packages’ on cable television, which one has to pay for to watch. Those who do not pay, can not watch the programmes that are included in the package, but when you watch a programme in the package, your usage will not reduce the ability of other paying consumers to also view the programmes in that package.

- If it is difficult to exclude people from consuming a good and there is no competitive consumption, it is called a public good. Typical examples are the prevention of crime or national defence, which provide protection to everyone within a specific area. As the goods can not be divided and sold to those who want to pay, they are usually secured through tax payments from the population of the relevant areas. In this way, governments seek to avoid situations where individuals can free-ride, i.e. attempt to avoid paying even though they benefit from the protection that others in the area pay for.

- In contrast, if consumption is competitive, and it is also difficult to exclude people from consuming the good, it is called a common good (or common pool resources). Fish stocks in the sea and groundwater resources exhibit these characteristics. It is difficult to prevent people from consuming such resources, and when too many people use them, problems connected with overuse may occur.

In practice, the classification is not as clear-cut as described above. There are many border cases between the different types, while the position of a good may change over time. For example, technological change may influence the potential for excluding people from using a good, such as GPS, which has made it easier to control who is catching fish in the oceans. The degree of scarcity also changes over time, so that natural goods, such as pure water, can change from being public goods with low rivalry in consumption to being common goods.

Schematic categorisation of types of good.

With regards to the environment, common goods and public goods give rise to particular problems. When there is a lot of pressure on resources, common goods can easily become overexploied. For example, overfishing can lead to the gradual depletion of the fish stock and, thus, limit fishing in the future. In order to solve such overuse problems, rules about who can fish, how much and when must be implemented. As a rule, the smaller the scale and the fewer the parties involved, the easier it is to establish these rules. In relation to the overexploitation of fish stocks, it is possible to control who has access (the right) to fish locally (in lakes, rivers or coastal waters) by issuing fishing permits. In the case of commercial fishing, where fishing takes place in certain marine areas, the countries that have fishing interests in these areas negotiate with each other about the size of the fishing quotas. During these negotiations, the countries decide who is permitted to fish in the area concerned, and how much fish they are allowed to take.

The climate problem is an example of how difficult it can be to share the burden when it comes to providing a public good, in this case a climate where the temperature rise is limited to one-and-a-half or two degrees. Our local consumption of fossil fuels and the associated CO2 emissions contribute to the greenhouse effect and change of the global climate system. The consequences of this are not only felt now (for example, extreme weather conditions are occurring more frequently), but are also expected to affect the living conditions of future generations. Reducing CO2 emissions would be beneficial for everyone, but it has proved very difficult to reach agreement on binding agreements to do so. This is due to several factors: the fact that many countries are heavily dependent on fossil fuels, differences in countries’ development – for example, a fear among developing countries that their opportunities for improving living standards will be limited – and conflicting interests within each country with regard to the phasing out of fossil energy sources. If we do not get CO2 emissions (and other greenhouse gases) under control, we expect a global temperature increase of as much as six degrees. According to the famous climate scientist, James Hansen, this would lead to ‘a completely different planet’.

Next: Property rights and commons