Distribution of use values in a society

Inge Røpke

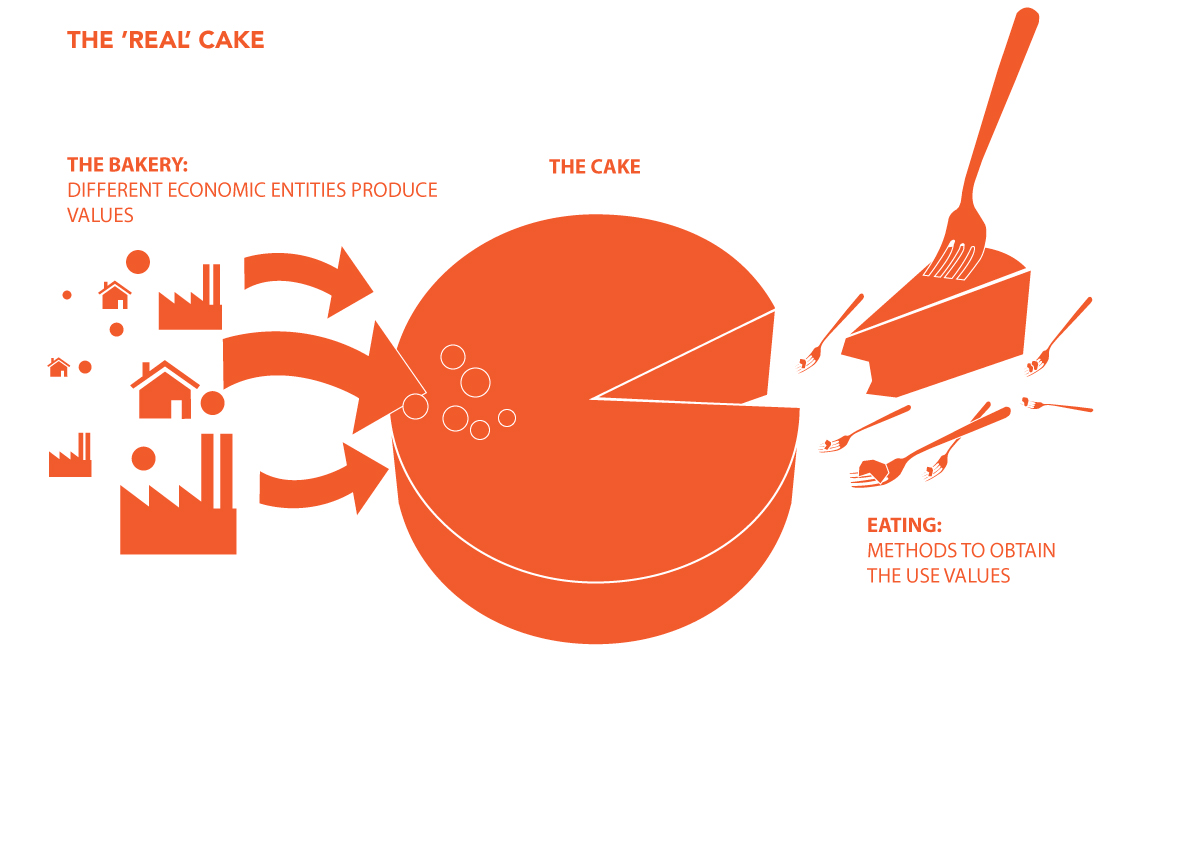

As previously mentioned in the theme on growth, ecological economics supports the idea that a society produces a ‘real cake’ during the course of a year, an amount of use values that society can either consume during the year or invest in future consumption opportunities. Even though the production result can not be measured in a meaningful way, we still have a clear idea that it will be unevenly distributed. Some groups in the society get better food, have larger homes, are more mobile, etc. than others. The distribution of goods is an aspect of the way society and the economic activities are organised.

Distribution is considered to be a political question, which mainstream economists will often seek to avoid by directing it to politicians. Many mainstream economists believe that their personal theories about how the economy works is value-free and can be used as a neutral basis for political debates. However, ecological economists consider this view to be totally misleading and instead emphasise that values are integrated in the concepts and perspectives one uses. In the field of ecological economics, distribution is clearly addressed: the recognition of biophysical limits is combined with a desire to redistribute to the benefit of the poor. Today we live in a world of great inequality and widespread poverty, and there is a great need to improve the living conditions of the most disadvantaged.

Biophysical limits imply that it is impossible to solve poverty problems solely through growth. Technological development may well make it possible to obtain more use value and higher living standards out of the resources, but this will still be insufficient. If this view of the situation is combined with a value-based belief that all people should be guaranteed good living standards, it results in an ethical demand to redistribute to the benefit of the poor.

Basic model for distribution

The traditional neoclassical circular flow model, where companies sell goods and services to households, which sell production factors to companies, encompasses the idea that production factors are paid in proportion to their contribution to production. The theory, thus, legitimises inequality as a result of anonymous market forces. In ecological economics, the basic model is different: there is no circular flow where everything fits together.

Instead, on the one hand, there is a production process where many different economic entities (companies, households, public institutions, local communities, organisations, etc.) help produce the production result – the real cake of use values – some of which are traded on markets. On the other hand, there is a distribution and consumption process, whereby members of society gain access to the use values by way of a number of methods. To continue with the cake metaphor, there is no general connection between individuals’ contribution to the bakery and their access to eat the cake. The allocation mechanisms are far more complex and are based on a long history of conflicts and power relationships that have crystallised into the current institutions and mechanisms.

Distribution mechanisms

The most decisive factor in terms of an individual’s access to use values is where they were born or possibly where they are living. Branco Milanovic, who is an expert in the study of distribution, calls it ‘citizenship rent’ – that an individual’s living standards depend more on where they are than what they do. You can be hard-working in a developing country and yet get very little out of it because your tools and society’s infrastructure are poor (as neoclassical economists would emphasise), and because local and global power structures put you in a weak position in the struggle for distribution. Personal effort is not the most decisive in terms of benefit.

It is obvious to divide a society’s allocation mechanisms into two broad groups depending on whether they are linked to markets or not. In markets, access to goods is determined by whether you have purchasing power in the form of money, while access in other contexts is decided by other types of institutions. For example, the distribution mechanisms within a household are usually based on conventions about who is entitled to what, to which there is a major element of care attached. With regards to the public sector, the distribution of goods is often based on rights. These may be rights to the transfer of purchasing power in the form of, for example, pensions or support for education, or they could be in the form of access to use goods, such as medical assistance or education, which are made available by the public sector.

As previously mentioned, purchasing power is crucial to be able to secure goods on markets. In modern societies, the vast majority depend on acquiring purchasing power. Some use value is created within households, for example, when we grow vegetables in the garden, make food, clean and look after the children. However, households also need a lot of goods and services that they can not produce themselves, while they have to acquire raw materials and equipment from other parts of the economy for their own production. How do they obtain purchasing power? In our society, most people would probably first think about working to gain purchasing power:

When we contribute to producing the real cake, we get a salary. Purchasing power can also be obtained by virtue of ownership of assets that are used in production such as land, buildings, machinery, patents, trademarks and other rights. The assets may be owned by individuals directly or indirectly through their ownership of, for example, shares in a company. Financing production through lending can also provide access to payment in the form of interest.

According to the neoclassical circular flow model, everything fits together: When companies sell goods, an amount is received which pays for the production factors in the form of salary, interest on loans, payment for the use of patents, stock dividends, etc. However, everything does not fit, partly because purchasing power also occurs in the form of capital gains. If a company is successful with its goods or if it owns an important patent, the price of its shares may increase. The owners can convert this into purchasing power through, for example, borrowing. Purchasing power can also arise in relation to the ownership of other assets as property rights sometimes provide a particularly high profit as a result of changes in society. For example, when railways were established, the land near the new stations increased in value. This form of earnings which is created by society is called ‘rent’ or ‘unearned income’ – a gain that the owner of the asset acquires solely through ownership and not by virtue of any effort. A more recent Danish example is the capital gains that many homeowners received as a result of the introduction of new types of loan in the early 2000s. Assets can also decrease in value, for example, land or houses losing value due to the construction of wind turbines or motorways nearby.

The allocation of purchasing power among society’s citizens, to a large extent, is based on the balance of power and associated institutions. The balance of power is decisive, not least for the relationship between what can be earned through work and ownership of assets, respectively. In societies with strong employee organisations, a relatively higher amount can be earned via paid employment than in societies with weak organisation. Historical conditions play a major role in the balance of power. For example, the large sacrifices made during WWII created the basis for strong ideological support to the construction of a welfare society for all, which was, amongst others, based on wealth taxes and a high rate of tax on high incomes. The establishment of the welfare state’s social security system also put a limit on how hard workers could be pressurised. In many countries, this social compromise was actively attacked from the 1980s onwards, so the owners of assets became far stronger in the struggle over distribution. This has gradually manifested itself in the form of changed tax systems and a weaker social security safety net. In addition, privatisation has facilitated the establishment of private property rights for assets that had previously been communal or publicly owned. For example, this applies to different types of infrastructure and resources such as fish. Furthermore, the patenting of new areas, such as software and genetically- modified organisms, has been opened.

Purchasing power through credit

In modern societies, credit plays a major role in the distribution of purchasing power and the relationship between the flow of purchasing power and the real cake. In societies with well- developed banking systems, it is possible for companies and people with new ideas to start something without having the necessary purchasing power. Furthermore, they do not need to borrow purchasing power from others who would have to give up purchasing power because the banks (and the state) can create new purchasing power. In practice, it works as follows: the bank gives the company a loan of, for example, 1 million DKK, partly by preparing a loan document, which says that the company owes the bank 1 million DKK, which is subject to a certain rate of interest and which has to be paid back in a certain way; and partly by increasing the amount in the company’s bank account by 1 million DKK. The amount does not come from anywhere else; it is created as soon as the figure in the bank account is increased. The amount is now money, i.e. a commonly accepted means of payment. There is a limit to how much money a bank can create in this way, but there is a lot of scope for creating new purchasing power. The fact that money can be created through credit provides great opportunities for starting new production and, thus, increasing the real cake. At the same time, the process makes some new demands on the real cake. Firstly, the loan must be repaid plus interest. Secondly, the owners who may, for example, have contributed share capital, expect a return. The institutions of society can easily be arranged so that lenders and owners earn a return on their assets, which increases purchasing power more than the real cake increases as a result of the new initiative (if it was possible to measure the growth of the real cake).

The disparity between purchasing power and growth of the real cake is increased when banks create purchasing power, which they lend for the acquisition of existing assets such as housing. Trade in existing assets does not increase the real cake (although, in some cases, its usefulness), but the demands on the cake increase as the flow of purchasing power increases. The same occurs when the growth of society generates undeserved income in the form of capital gains. In addition, since the 1980s, the financial sector has developed increasingly complex mechanisms that increase the flow of purchasing power without contributing to the real cake. As a result, the total purchasing power demand on the real cake increases far more than the cake itself, and an increasing proportion of the demands are appropriated by the groups that are already best placed.

Increasing inequality is a problem in itself, especially in a world of biophysical limits. In addition, the imbalance contributes to the emergence of economic crises, while the financial mechanisms create bubbles with increasing asset prices as well as mountains of debt, which trigger financial crises.

The consequences of uneven distribution

Various institutions and mechanisms reinforce inequality once it has emerged. For example, the opportunity to inherit implies that new generations in rich families do not have to start from scratch, but instead enter the struggle over allocation with good cards in their hand. At the same time, large fortunes provide special opportunities to obtain higher interest rates and exploit tax havens, which companies in strong positions can utilise to become even stronger. In the United States, in particular, the question of whether significant inequality is undermining the political system because money has become so crucial for gaining political influence is being increasingly discussed.

The allocation mechanisms are sometimes defended by arguing that they help support technological development. For example, the patent system allows the initial outlay to be recouped after investing heavily in development. However, the system is being increasingly criticised for being too lucrative and, in some cases, a hindrance to development. More generally, it may make sense to introduce incentives that promote innovation, but the current structure of the allocation mechanisms leads to results that are completely out of proportion.

The desire to promote innovation is often linked to the idea that it increases the size of the real cake that is to be allocated. It is true that innovation can help increase the amount of use value derived from the resources, although this is not necessarily the case. In this regard, it is important to consider the more general point that both the direction of innovation and the composition of the cake are strongly influenced by the distribution of purchasing power. The cake is not baked first and then allocated afterwards. On the contrary, purchasing power determines what sort of cake is going to be baked.

[otw_shortcode_info_box border_type=”bordered” border_style=”bordered”]

Eflornithin and sleeping sickness

In this section, it is argued that the demand, based on the ability to pay, has an influence on the content of society’s cake. There follows an example of this from the textbook on ecological economics by Herman Daly and Joshua Farley.

Some decades ago, the pharmaceutical company, Aventis, developed a drug called Eflornithin, which could cure African sleeping sickness. There was high demand for the drug among poor Africans, but unfortunately they did not have enough purchasing power to ensure satisfactory income from the product as far as Aventis was concerned. Instead of marketing the product by focusing on curing African sleeping sickness, Aventis chose to sell the patent to another pharmaceutical company, which used Eflornithin as a drug to treat unwanted facial hair on women. This new product was in high demand among wealthy Westerners. This illustrates how purchasing power can be decisive in terms of which products end up on the market, thereby becoming a part of society’s cake.

However, this particular story ended well as the organisation, Médecins Sans Frontiers (Doctors Without Borders), threatened to publicise the issue, which forced Aventis to resume production of Eflornithin as a medicine against sleeping sickness for poor Africans.[/otw_shortcode_info_box]